Business Times | 18 Jan 2021 | Lynette Tan; Additional reporting by Lelia Lai

ONGOING supply chain issues and unpredictable demand due to the coronavirus pandemic are making it hard for food manufacturers and suppliers in Singapore to do their usual roaring business during the peak festive seasons.

For some, the supply chain issues resulted in missed opportunities to capitalise on demand from locals un- able to travel over the holidays.

Seng Hua Hng Foodstuff, which produces nut snacks under the Camel brand, faced a shortage of some products as a result of delays in Its shipments of raw ingredients from various countries.

“There were incidences of port disruptions, large spikes in shipping costs from China, and also shipping delays due to suppliers unable to book shipping vessels,” said managing director Poh Ah Seng.

The company’s Christmas sales were still similar to that of the year before, as it was able to sell more of other products in its range. However, “it also means that we could have done much better, if we had received our raw materials on time, as this year many of our fellow Singaporeans are here on our sunny island, feasting on all kinds of local food,” said Mr Poh.

Similarly, Zoe Anastasis Trading, which supplies dried goods, had to import a smaller range of products this year. Instead, the company brought in larger quantities of products which were “more suitable to the majority of our customers,” said partner Wong Ze Lin.

“Of course, not all customers were happy with the fewer options we had,” said Mr Wong.

Huber’s Butchery, on the other hand, had to close its Christmas orders early due to overwhelming demand. “It was so difficult to predict demand for Christmas in 2020 as we had never experienced this situation before,” said Andre Huber, executive director of Huber’s Butchery. “We did not know if customers would dine out more or throw home parties as this was also dependent on the ruling governing gathering size and alcohol curfew,” Mr Huber added.

With Chinese New Year and Valentine’s Day now about a month away, supply disruptions also mean that some food manufacturers, like Seng Hua Hng, are incurring more costs as they ramp up production to make up for lost time.

These challenges appear to have prompted some food manufacturers to seek out more warehouse or cold storage spaces, to hold more stocks as a buffer.

Tan Boon Leong, executive director of capital markets for industrial at Knight Frank Singapore, said that the real estate consultancy has received “more supply chain-related enquiries” in recent months, especially from businesses covering the entire food production or distribution chain. The spaces are being used in a variety of ways, including as ingredient storage, central kitchens and distribution outlets.

However, warehouse space supply has been tight due to competing demand from the stockpiling of masks, sanitisers and essential food items, said Mr Tan, adding that rentals have been trending upwards by 10 to 15 per cent now since the start of last year.

Generally, food manufacturers and suppliers’ ability to stock up is also constrained by the shelf life of produce and sales performance, which is especially unpredictable during the pandemic.

As a purveyor of quality chilled meats, Huber’s Butchery will have to shoulder the higher freight costs to secure space on flights for meats with shorter shelf lives, said Mr Huber. Chilled chicken meat, for example, can only be kept for up to a week.

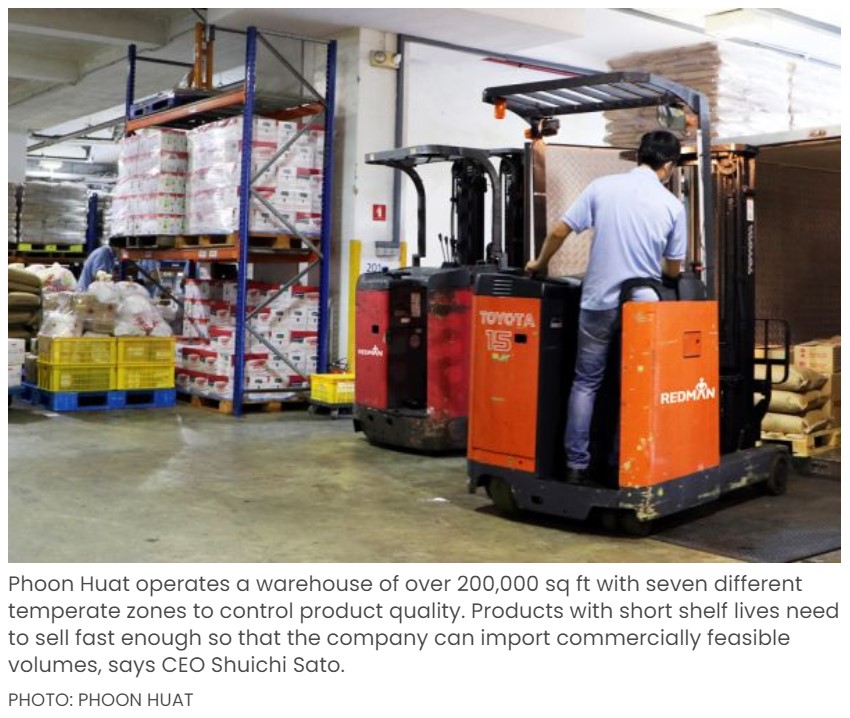

Shuichi Sato, CEO at Phoon Huat, added that shelf-life management costs need to be considered. The company operates a warehouse of over 200,000 sq ft with seven different temperate zones to control product quality.

In addition, products with short shelf lives need to sell fast enough so that the company can import “commercially feasible” volumes, Mr Sato said.

Some food manufacturers and suppliers are thus finding it more practical to diversify their sources of supply or give more lead time to their suppliers instead.

Annabella Patisserie, which specialises in making macarons, has what it calls a +1 strategy-keeping on hand alternative suppliers for the same or next best ingredient-after facing a shortage of key baking ingredients, like flour, before Christmas.

Meanwhile, Colden Bridge Foods Manufacturing, which specialises in processed meats, is providing its suppliers with a 12-month forecast of its orders. “This allows our suppliers to plan and prepare beforehand if there is a sudden need to procure more supplies,” the company said.

For the end-consumer, Mr Poh quipped, the good news is that Seng Hua Hng’s nuts in the market now are all from the latest crop, and freshly roasted from the oven.